Move to Net Zero now. No risk. No cost.

From advanced, hydrogen-ready CHP (combined heat and power) solutions to grid-scale renewable technologies, EuroSite Power can help you to achieve your net zero ambitions quickly. All fully funded, with no upfront cost to you.

We invest in designing and installing the best system for you. Then we own and operate it on your behalf for a fixed term. You benefit from a generous, guaranteed saving on standard energy costs, as well as taking a step closer to your zero carbon goals.

Your accelerated journey to net zero starts with a conversation. Let’s talk.

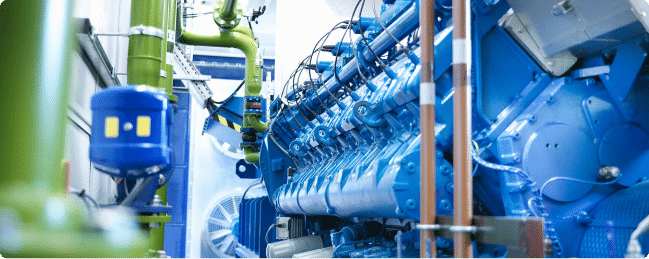

Green CHP

Cut carbon and save costs using green gas combined heat and power solutions that are also hydrogen-ready.

Renewable Energy

We’re investing in both grid-scale and on-site renewable energy generation assets – including multi-MW wind and solar farms as well as battery storage – to bring you net zero, sustainable power. For corporate customers we also offer on-site solutions ideally suited to those operating multiple sites.